How to list your company at the Mexican Stock Exchange?

- Incrementar

- Incrementar

| (5255) 5342-9037 / 5342-9183 | |

| promocion@grupobmv.com.mx |

The Mexican Stock Exchange maintains qualitative and financial standards for its listed companies. If a company is unable to comply with these standards, can prepare and implement the necessary standards to comply with the requirements.

- We'd like to hear from you!

- Implement an effective Corporate Governance Model

- Legal constitution of the Board of Directors.

- Administrative and Operative processes formally documented.

- At least one Independent Counselor.

- At least one support committee. (Audit, Corporate Practices, Planning, Risk Management, Remuneration).

- Institutionalization.

- Risk Management.

- Information Security.

- Improved Control Environments.

- Improved top level decision-making processes.

- Attractive investment projects.

- Management equity and information transparency.

- Financial growth, reduction in firms’ cost of capital, improved financial structure increase in assets value.

- Work closely with an Underwriter Firm (Brokerage Firm):

- Work with a Rating Company:

- Submit the Registration Application form

- Sales and Promotion of Securities

- Securities’ Maintenance

If you want to know more about your company going public at the Mexican Stock Exchange, please send your inquiries to promocion@bmv.com.mx and we'll get back to you as soon as possible; or call Promotion at +52 (55) 53.42.90.37 and +52 (55) 53.42.91.83 and we will provide the steps that best fit your company’s necessities.

Expert advice will be required to implement an effective mechanism to regulate the relationship between shareholders, counselors, and administration at the company. If your company doesn’t have a solid Corporate Governance structure, contact us to asses you with the first steps to develop your company. An effective Corporate Governance means access to capital, competiveness and continuity.

When you implement a Corporate Governance Model, you must take into consideration:

Benefits:

An underwriter firm is a brokerage firm which subscribes the prospectus with the listed company and it is in charge of reviewing and performing a deep analysis of every document delivered by the listed company and the business itself. These actions take place to list the company at the stock exchange, and to get approval of the public offering. The underwriter firm will be responsible of coordinating the company’s public offering – General provisions for the underwriter firm (National Banking and Securities Commission) -.

You must choose a brokerage firm which adapts to your company’s culture, goals and objectives. The decision should not be based on the reputation and trajectory of the firm but in its credibility and perspective of the professionals working with you.

The Price must be determined by the listing company and the brokerage firm in conjunction. The price must be determined based on market conditions and the company’s potential. At the secondary market, prices are determined by offer and demand transactions.

Bond certificates’ price and the specific characteristics as: total amount, nominal value, term, date of emission, interest rate, interest payment, among others, must be determined by the listed company and the brokerage firm for each emission.

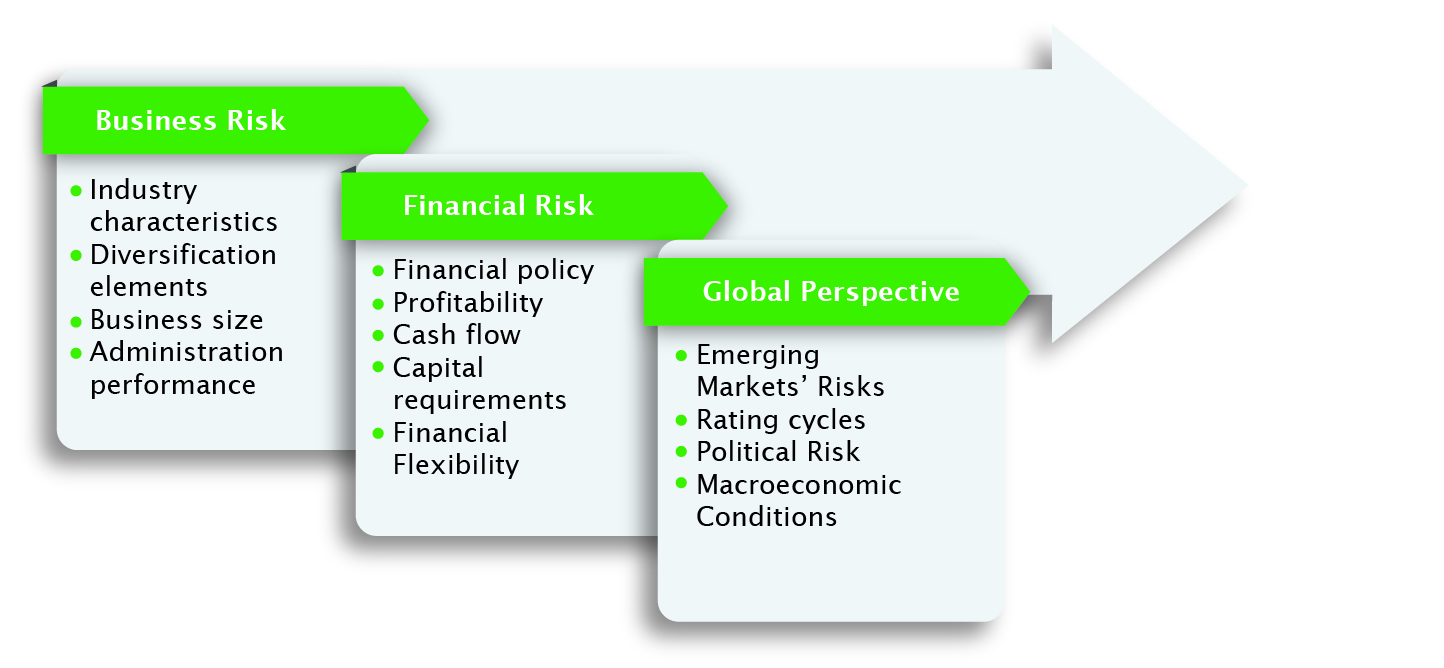

A rating provided by a rating company determines the probability whether the prospective entity will be able to meet its obligations. Ratings can be assigned to short-term and long-term debt obligations and determine the probability whether the prospective entity won’t meet its obligations in terms of the bond value at maturity or payment of interests. Therefore, the ratings lie on a spectrum ranging between highest credit quality on one end and default or "junk" on the other. Some evaluation elements included in the rating process are:

The application and authorization of the public offer’s documents, in accordance with the dispositions of general character that applies to the listed companies and other participants to the stock market (Securities Issuers’ General Regulation) by the National Banking and Securities and its appendix, can be found in the Requested Forms” tab in this section.

Download the Practical Guide File - How to List your Company at the Exchange

Promotional presentations are fundamental events in the securities’ sale process. Your company will be presented to the key public investors, including to the sales force and possible institutional investors.

The administrator should provide the main benefits that are obtained every time an investor believes and invests in the company due to outstanding financial performance and trajectory.

The underwriter consortium should distribute the company’s securities and provide price stability, continuing support in the buy/sales process and will handle sponsorship resources, such as investors’ conferences and promotional presentations without trading purposes.

The analysts, who working for the brokerage firms and are involved in the public offering, are key elements to present your company to the investors’ community. Ensure they deeply understand you company and their experience in your company’s sector.

The companies interested to be listed in the Mexican Stock Exchange, should consider the following aspects for the maintenance of their securities:

Comply with the basic requirements and standards that indicate the current regulations of the National Banking and Securities Commission and the Mexican Stock Exchange according to the specific characteristics of the security you want to list.

The Mexican Stock Exchange has a specialized area that offers users information, systems support and guidance for the timely submission of documents for the public companies, according to the guidelines for registration and maintenance of the Mexican Stock Exchange.

Contact us at the Promotion for Listed Companies Department at emisoras@bmv.com.mx or call us at +52 (55) 5342. 91.23.